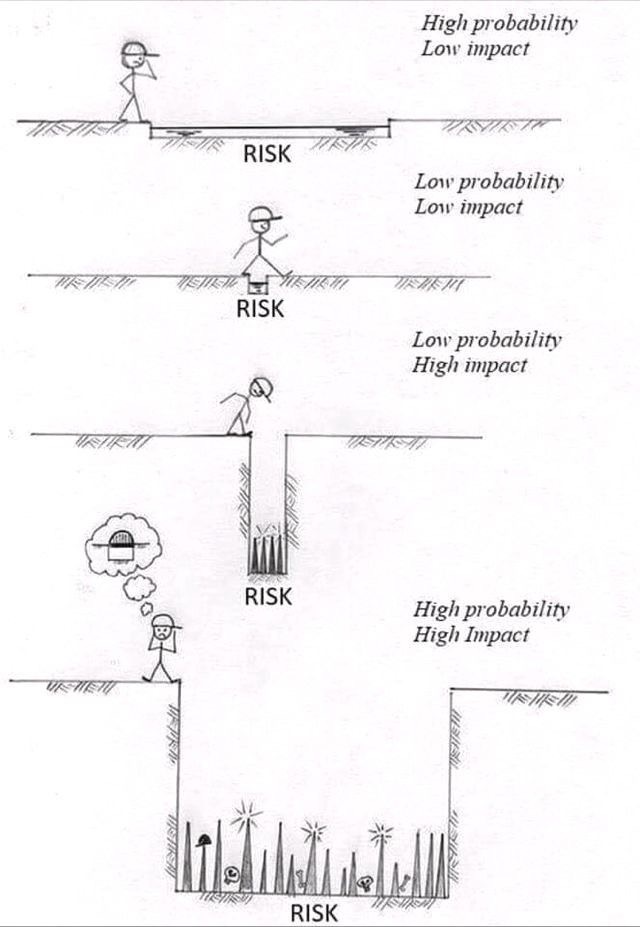

Creating a comprehensive risk assessment for a company involves identifying potential risks, evaluating their potential impact, and developing strategies to mitigate or manage these risks. I. Executive Summary Provides a brief overview of the company's risk assessment, highlighting key findings and recommendations. II. Introduction A. Purpose of the Risk Assessment Clearly states the purpose of the risk assessment, such as identifying and managing potential risks that could impact the company's operations, finances, and reputation. B. Scope Defines the scope of the risk assessment, specifying the areas, departments, and processes that will be evaluated. III. Risk Identification A. Strategic Risks 1. Market Risks: - Changes in market trends - Competitive landscape shifts 2. Operational Risks: - Supply chain disruptions - Technology failures B. Financial Risks 1. Market Risks: - Exchange rate fluctuations - Interest rate changes 2. Credit Risks: - Customer credit defaults - Counterparty risks C. Compliance Risks 1. Legal and Regulatory Risks: - Changes in legislation - Non-compliance penalties 2. Ethical Risks: - Reputational damage due to unethical practices D. Environmental and Social Risks 1. Environmental Risks: - Regulatory changes - Climate-related impacts 2. Social Risks: - Stakeholder relations - Employee satisfaction and retention IV. Risk Assessment A. Risk Impact and Probability 1. Impact Assessment: - High, Medium, Low 2. Probability Assessment: - High, Medium, Low B. Risk Matrix Creates a risk matrix mapping identified risks based on impact and probability. | \ | High Impact | Medium Impact | Low Impact | |---|-------------|---------------|------------| | High Probability | Critical | Major | Moderate | | Medium Probability | Major | Moderate | Low | | Low Probability | Moderate | Low | Negligible | V. Risk Mitigation Strategies A. Strategic Risks 1. Market Risks: - Diversify product/service offerings - Monitor market trends regularly 2. Operational Risks: - Implement redundancy in critical processes - Regularly update and test technology systems B. Financial Risks 1. Market Risks: - Hedge against currency fluctuations - Monitor interest rate trends 2. Credit Risks: - Implement robust credit assessment procedures - Diversify customer base C. Compliance Risks 1. Legal and Regulatory Risks: - Stay updated on regulatory changes - Establish a legal compliance team 2. Ethical Risks: - Develop and enforce a code of ethics - Conduct regular ethical training for employees D. Environmental and Social Risks 1. Environmental Risks: - Adopt sustainable business practices - Stay informed about environmental regulations 2. Social Risks: - Implement employee engagement programs - Develop a stakeholder communication strategy VI. Monitoring and Review Establishes a regular review process to ensure the effectiveness of risk mitigation strategies. A. Key Performance Indicators (KPIs) Defines KPIs to measure the success of risk mitigation efforts. B. Monitoring Frequency Specifies how often the risk assessment and mitigation strategies will be reviewed. VII. Reporting Outlines a reporting structure to communicate risk assessment findings and updates to relevant stakeholders. VIII. Conclusion Summarizes the key findings of the risk assessment and reiterate the importance of ongoing risk management. Note: This template is a general guide, and you may need to customize it based on the specific characteristics of your company and industry.

Company Risk Assesment Module

High Efficiency product for Company selfassesment

Marketing up to 25% from turnover Solution development up to 50% from turnover Fixed cost for equipment up to 25% from turnover in the 1st year

57% max depending on purchase